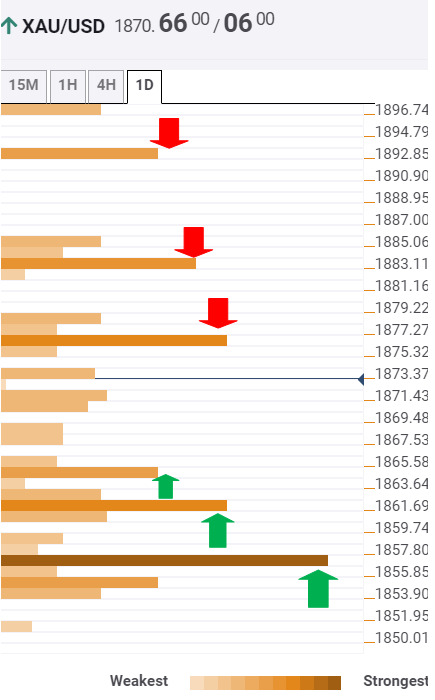

Gold Price Chart: Key resistances and supports

The Technical Confluences Indicator shows that gold is set to challenge a major resistance at $1877, which is the confluence of the SMA100 four-hour and Fibonacci 23.6% one-month.

The next relevant bet for the buyers is seen at $1884, the pivot point one-week R2.

Acceptance above the latter could open doors towards $1893, where the Fibonacci 161.8% one-week is located.

To the downside, the bulls will need to defend a dense cluster of support levels around $1870, which is the convergence of the previous day high and the previous low on 15-minutes. Also, forex market analysis may result in profits if taking the point seriously.

Further down, the previous week high at $1864 could test the bears’ commitment.

The Fibonacci 23.6% one-day at $1862 will offer the next support, below which $1857 would be tested. That level is the confluence of the Fibonacci 38.2% one-day and one-month.

Here is how it looks on the tool

About Confluence Detector

The TCI (Technical Confluences Indicator) is a tool to locate and point out those price levels with congestion of indicators, moving averages, Fibonacci levels, Pivot Points, etc. Knowing where these congestion points are located is very useful for the trader, and can be used as a basis for different strategies.